Page 20 - 2022 NUROL YES SUSTAINABILITY REPORT

P. 20

OCCUPATIONAL WORKING OUR PERFORMANCE APPLICABLE

CORPORATE FINANCIAL SUSTAINABILITY ENVIRONMENTAL VALUE CHAIN UNGC CONTENT

PROFILE OUTLOOK GOVERNANCE APPROACH AWARENESS HEALTH AND MANAGEMENT LIFE IN NUROL CONTRIBUTION TO INDICATORS INDEX GRI SECTOR

SAFETY CONSTRUCTION SOCIETY DETAILS STANDARD

FINANCIAL OUTLOOK

FINANCIAL INDICATORS

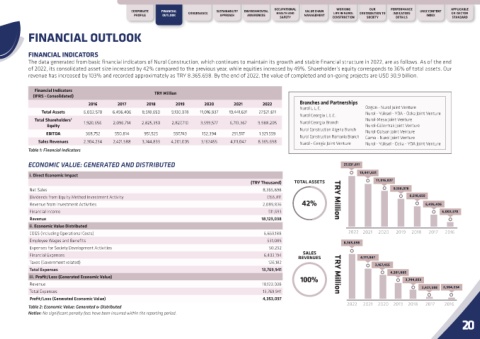

The data generated from basic financial indicators of Nurol Construction, which continues to maintain its growth and stable financial structure in 2022, are as follows. As of the end

of 2022, its consolidated asset size increased by 42% compared to the previous year, while equities increased by 49%. Shareholder’s equity corresponds to 36% of total assets. Our

revenue has increased by 103% and recorded approximately as TRY 8.365.698. By the end of 2022, the value of completed and on-going projects are USD 30,9 billion.

Financial Indicators

(IFRS - Consolidated) TRY Million

2016 2017 2018 2019 2020 2021 2022 Branches and Partnerships

Nurol L.L.C. Özgün - Nurol Joint Venture

Total Assets 6,002,570 6,496,406 8,518,650 9,130,078 11,016,837 19,441,631 27.521.611 Nurol - Yüksel - YDA - Özka Joint Venture

Nurol Georgia L.L.C.

Total Shareholders’ 1,920,656 2,096,714 2,825,350 2,827,710 3,599,577 6,713,367 9.988.205 Nurol Georgia Branch Nurol-Mesa Joint Venture

Equity Nurol-Gülermak Joint Venture

Nurol Construction Algeria Branch

EBITDA 368,752 550,814 951,525 597,743 152,394 291,517 1.321.559 Nurol-Gülsan Joint Venture

Nurol Construction Romania Branch Gama - Nurol Joint Venture

Sales Revenues 2,304,234 2,421,588 3,744,833 4,201,005 3,167,455 4,111,047 8.365.698 Nurol - Cengiz Joint Venture Nurol - Yüksel - Özka - YDA Joint Venture

Table 1: Financial Indicators

ECONOMIC VALUE: GENERATED AND DISTRIBUTED 27,521,611

19,441,631

i. Direct Economic Impact

(TRY Thousand) TOTAL ASSETS 11,016,837

Net Sales 8,365,698 9,130,078

Dividends from Equity Method Investment Activity 7,155,811 TRY Million 8,518,650

Revenue from Investment Activities 2,089,836 42% 6,496,406

Financial Income 511,693 6,002,570

Revenue 18,123,038

ii. Economic Value Distributed

COGS (Including Operational Costs) 6,659,188 2022 2021 2020 2019 2018 2017 2016

Employee Wages and Benefits 531,085

8,365,698

Expenses for Society Development Activities 50,292

SALES

Financial Expenses 6,403,194

REVENUES 4,111,047

Taxes (Government related) 126,182

3,167,455

Total Expenses 13,769,941

4,201,005

iii. Profit/Loss (Generated Economic Value) 100% TRY Million 3,744,833

Revenue 18,123,038

2,421,588 2,304,234

Total Expenses 13,769,941

Profit/Loss (Generated Economic Value) 4,353,097

2022 2021 2020 2019 2018 2017 2016

Table 2: Economic Value: Generated & Distributed

Notlar: No significant penalty fees have been incurred within the reporting period.

20